Why we like 3D Resources

Now that we've shown you around 3D Resources major prospects, lets dive into why we think they are a company to keep an eye on.

Near term production options present big upside

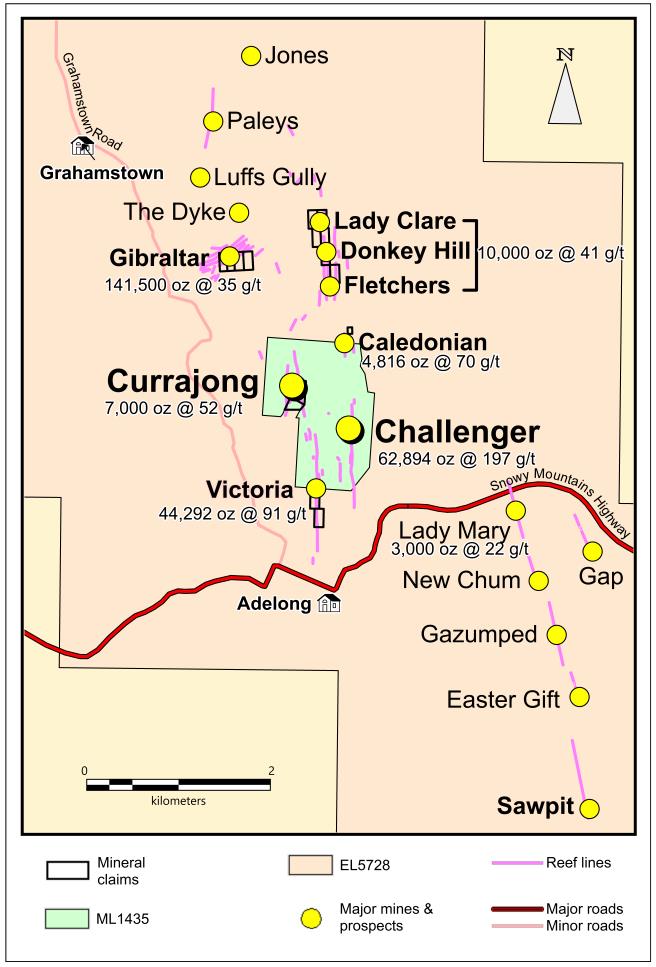

As shown on the map, the company has two prospects that they consider to be near term development options. When 3D acquired the prospects, the acquisition included all of the plant and equipment from the past operation.

Above: The facilities 3D Resources acquired along with the various Adelong prospects

Above: The facilities 3D Resources acquired along with the various Adelong prospectsThe plant will require upgrading and reconfiguring to operate efficiently and the company is currently undertaking an assessment the best path forward.

It's rare to find junior miners with a path to development being so clear. We see this as considerable upside should the company find an efficient and feasible way to bring the plant back into operation. We do note that significant costs will likely be incurred to bring the plant back into production, but anticipate that the costs would be significantly less than building a new plant from scratch.

Additional Inferred Resources could provide added value

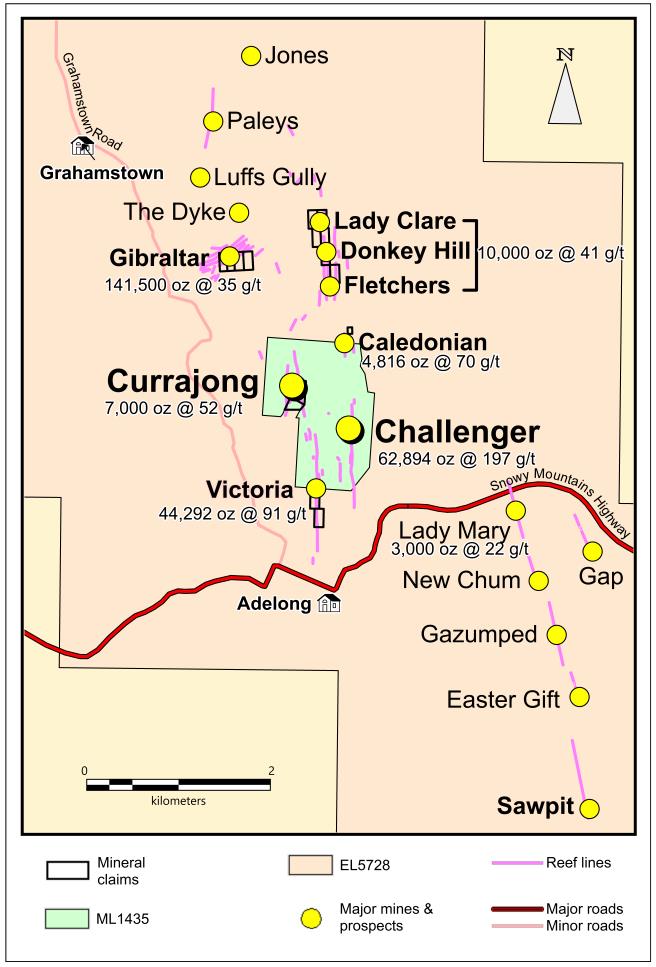

As noted in the map above, 3D Resources believes that it can quickly generate additional Inferred Resources for Donkey Hill, Gibraltar, Sawpit and some of the parallel structures to Currajong that are currently excluded from the resource estimates.

Above: A map depicting the companies major mines and prospects

Above: A map depicting the companies major mines and prospectsWe see this as adding significant value if the company succeeds in doing so, and should also serve as positive newsflow for the company going forward.

30% interest in Cosmo Gold

3D resources is also in the process of spinning out and IPO'ing a subsidiary, 'Cosmo Gold'. Cosmo Newberry is one of the few remaining under explored greenstone belts in Western Australia.

Under the terms of the mandate, Cosmo Gold will pay $750,000 to 3D as part consideration for Cosmo Newberry. Cosmo will then carry out IPO, with 3D to maintain a stake in the company. Note that this is to be voted upon at 3D's Shareholder Meeting held on December 21.

This seems to favourable outcome for 3D shareholders. Not only does it allow 3D to focus their efforts on the Adelong region, 3D shareholders maintain exposure to another exciting gold project while also allowing that project to become funded.

Conclusion

3D Resources seem to be in the right place at the right time, a junior gold company looking to turn into a producer at a time when the gold price is close to 10 year highs.

We'll be keeping a close eye on it's Adelong prospects throughout 2021.

Disclaimer:

Modern Investor accepts no responsibility for any claim, loss or damage as a result of information provided or its accuracy. The information provided on this site is general in nature, not financial product advice. Your personal objectives, financial situation or needs have not been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.

Above: The facilities 3D Resources acquired along with the various Adelong prospects

Above: The facilities 3D Resources acquired along with the various Adelong prospects